by David Glenn | May 27, 2016 | CRESTICO

Buying a home is a pretty big step in our lives. And knowing just what to do, how to do it, or everything that you need to do can get tricky and confusing. There a lot of people who will give you a lot of advice, but there are just a few that you should definitely pay attention to. We’ve rounded them up for you here to make that transfer from potential buyer to homeowner.

Homeowner’s Insurance

This is a big one. Homeowner’s insurance is one of the most important things that you can invest in for your new house. This insurance, like all insurance, is meant to keep you and your family and property safe from any potential damage or situations that occur.

Along with homeowner’s insurance, investing in a home warranty plan is also a very handy and important addition to your new space. A home warranty plan is a great way to keep your home systems, appliances, and so much more safe from the everyday wear and tear that comes from home life and from those “rainy days,” like a flooded basement, electrical fires, or just rambunctious guests or kids.

DIY Fixes

As a homeowner, unless you’re rolling in the dough, a great thing to do is learn how to do typical home maintenance and fixes yourself. Hiring a professional for every break, scrape, tear, leak, and more can really add up. Learning and teaching yourself how to do the basics can help you save so much in the long run. As a homeowner you need to become a bit of a “handyman.” You now own the space and don’t have a manager to rely on to take care of every clogged toilet or rouge ant parade in your home.

There are a lot of resources out there that can help you walk through how-to’s on fixing typical repairs around the house. You can check out DIY fixing websites or even Pinterest boards to help expand your new skill sets.

Home Maintenance

If you’re not buying a brand new home or building, there are a few things you should definitely do when you move into your new home.

Change the locks. Though the past homeowners may have given you all the keys they have, there might be a rogue cousin or neighbor who still has a set or two and you don’t want to run any risks. Install new deadbolts and even handle locks. You can do this for less than $10 per lock, or you can call a locksmith to have it down professionally. If you supply the new locks, the locksmith will generally only charge about $20 to $30 per lock for labor.

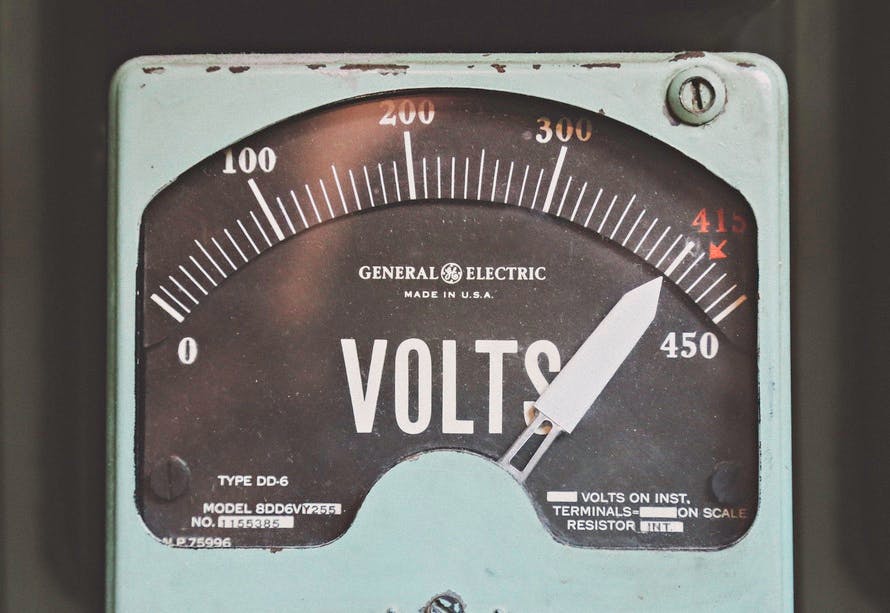

Check the insulation in the attic. If there isn’t enough, install more. This can actually be a money-saver tip too. There should be at least six inches of it everywhere. If it looks damaged, replace it too. A few other great things to do is to check for pipe leaks, replace air filters, clean out vents, air-seal the house, steam clean the carpets, spray for insects and pests, and check the breaker panel and outlets.

These are all great things to do before you move all of your furniture and personal belongings in. They are also things that might have gone unnoticed in an inspection. Once you do a good once-through of the house, start a brand new home maintenance checklist. You can find a template online. This will help you know when to change out smoke alarm batteries, air filters, and to service any home systems. Staying up-to-date on your home maintenance can help you to avoid any big repairs or disasters in the future.

Being Married to Your Mortgage

Too many homeowners think about their house as an investment instead of a cost-of-living. Your house is not an investment unless you can afford to give it up! This is not the case with most homeowners. Prior to getting a mortgage you should prepare to be spending a large sum of your monthly income, but not every penny. You want owning a home to be an experience that enhances your freedom, not restrict it. If you’re spending every earned penny on your mortgage then very little will be left over for desired non essentials that are still important. For instance, Weekend getaways, eating out with friends, Tour groups, and more. You should be able to have enough for a car or appliance break down (a rainy day fund) and then a little left over for the nice things in life.

by David Glenn | May 26, 2016 | CRESTICO

For many, home improvements mean new countertops or a walk-in steam shower. But when it comes down to increasing the value of your home or selling it, these kind of home improvements might not be the best to invest in. Here are some of the best home improvements that have the biggest returns.

Kitchen or Bathroom Remodel

According to HGTV, a kitchen remodel has a return investment of 100 percent of the cost. In San Diego, a $17,928 kitchen remodel returned $27,000 on resale. Remodeling a kitchen or bathroom can be one of the best home improvement projects you ever do. When you start planning your remodel focus on traditional aspects such as wood cabinets, stone or natural wood floors, stone countertops and commercial-looking appliances. These will create a more timeless look in your home. Replace a whirlpool tub with a walk-in shower to open up space or add a second bath if you only have one.

Siding Replacement

Since it’s on the outside of your home, siding can get a real beating and affect your curb appeal. Old, worn siding can contribute up to a loss of 10 percent of your home’s value. Installing new siding can show potential buyers that you really take care of your home. New siding can come in a number of options, vinyl and fiber-cement being the the top options. Vinyl siding is low-cost, easy to install and very durable. Fiber-cement siding is a bit more expensive but its overall look screams quality. According to the “2015 Remodeling Impact Report,” it also has a 79 percent payback.

Replace the Front Door

Switching your old front door for a newer one could give you up to 91.1 percent return. Like siding, a new front door can add to the overall curb appeal of your home. You can even add stained glass to the front door. Simply reach out to a stained glass film manufacturer to get some film which you can easily install for a quick way to add some color to your front door.

Replace your old one with a new steel door and you’re sure to see one of the best paybacks. Old doors can also be a big source of energy loss. Replacing an old door can not only give you a better return but it can also help you save on energy costs. A new steel front door has a median cost of $2,000 but you could recover around 75 percent of that at resale.

Add More Space

From changing an attic into a bedroom or study to adding another room or bathroom can be a great investment. Often times, buyers invest in the additions since they can’t afford a larger home in their neighborhood. According to the 2005 study for the National Association of Realtors every 1,000 square feet added to a house will boost the sale price by over 30 percent. The joke of having a room just for one’s shoes from the hit film The Italian Job, wasn’t that far off either. More and more people today are wanting a room specially dedicated for hobbies like a craft room, personal study or even a home gym. When you start adding space, be sure to keep your home’s price in the affordable range of your neighborhood or else it may never sell.

Add a Patio or Deck

A 2014 Home Trends Survey from the American Institute of Architects showed that patios and desk were on the rise. If you can’t afford to add a second room or bathroom, adding a patio or deck can be a less expensive investment at just $8 per square foot whereas a new addition could cost up to $150 per square foot.

Like a front door, the garage door is one of the first things anyone sees as they drive up to your house. Replacing a two-car, embossed steel door could cost up to $2,300 according to the “2015 Remodeling Impact Report,” but you can see up to 87 percent of that investment at resale. There are some truly wonderful new garage door styles from glass doors to accordion folding. Doing this is a definite improvement that has one of the biggest returns.

by David Glenn | May 19, 2016 | CRESTICO

Purchasing your first home might be one of the most expensive purchases you’ll make, which makes it even more important to do it right. The best way to go about shopping for a house is to line yourself up with a good realtor, explore financing and determine the priorities you seek in a new home. Most first time buyers make one or two mistakes during the process of buying a home. However, using these tips can help you to avoid mistakes and highlight important items to consider as you begin shopping for homes.

Determine What Features You Need

Before looking at homes, make a checklist of the features you need. For example, you might list the number of bedrooms, a large yard, fencing, home office and a family room. Next, you could list features that would be nice to have like a swimming pool, garden or patio.

Contact a Realtor

Ideally, if you’ve never been through the home buying process, you should consider working with a realtor to find a new home. He or she can show you several homes, write contracts, make recommendations and provide guidance for you as you complete the home buying and closing processes. Working with a realtor to find homes in the neighborhoods you like can save you time and money.

Realtors have access to the MLS (Multiple Listing Service), which is essentially a huge database of home listings supplied by Real Estate brokers. The listings include details and features about each property that is for sale. Your realtor can use the MLS to choose homes to fit your budget and location requirements, which makes it faster and easier to find your dream home.

Location Considerations

Unfortunately, many new home buyers fail to take into consideration the importance of where the home is located. For instance, you may have found the perfect home, but if it’s too far from work it may turn into a major problem. Before choosing neighborhoods, consider these questions:

Is a short commute to work a requirement?

- Does the home need to be in a good school district?

- Do we want nearby access to entertainment?

- Is public transportation a requirement or just a bonus?

Household Costs and Other Expenses

It is smart to get a rough estimate of what your monthly expenses will run for a new house before purchasing. To start with you’ll have the principal and interest on the home. Add in insurance and taxes. You may have to factor in home owner association fees. Next, you’ll want to consider power and water utilities. Don’t forget telephone and internet services.

Homeowners Insurance

The home and location can affect the cost of homeowners insurance, which is required when carrying a loan on the property.

- Homes located near fire stations or hydrants usually result in a discount.

- Home security systems may qualify for better rates.

- Neighborhoods in high crime areas cost more to insure.

- Homes in known flood zones or areas prone to earthquakes are more expensive to insure.

Home Inspection

Ordering home inspections on new or used homes isn’t a requirement for purchasing but it often proves to be a smart idea. Home inspectors provide an unbiased home inspection and cost about $300 to $500. They inspect the main household systems such as heating, cooling, electrical and plumbing.

Credit Check and Financing

Contact one of the three credit bureaus, and pull a free copy of your credit report before you consider financing and shopping for a home. Make sure the report appears to be accurate. The best Interest Rates for loans are offered to those people that have a good or higher credit score rating.

Keep in mind that you may have to put down as much as 20 percent for you down payment on the home. However, it’s possible, you may qualify for federally-backed loans, which often have Lower Interest Rates, small down payments or no down payment required.

Before shopping for a home, contact several banks and loan institutions to check their interest rates. It’s also a smart idea to get pre-qualified for a loan before home shopping.

Take your time to find the right home that meets all you requirements. Consider working with a realtor and a home inspector for professional services and recommendations.

by David Glenn | May 9, 2016 | CRESTICO

In all likelihood, if you’ve been living with your folks, in a dorm room or an apartment, you probably don’t know a whole lot about home maintenance, landscaping or home security. These tips may help to prevent costly mistakes, save money and help you to learn about homeowner responsibilities.

Valve for Water Shutoff

After purchasing a new or used home, you need to locate the main valve for shutting off the water to the home in an emergency. Shutoff valves are typically located near the water main where it comes into the home. Everyone living in the home should understand how to turn the valve off.

You may need to shut the valve off when pipes burst or an overflowing toilet floods the floors, carpeting, cabinets or wallboards. These items are difficult to dry out and can lead to costly repairs.

Landscaping

Planting new or additional landscaping is a wonderful way to add a bit of your own personality to the home, and it can help to keep your home much cooler during hot summer weather.

Choose trees and vines to plant on the southern and western sides of the home, which will provide much needed shade. Call 811 before you begin digging around your home to learn where wires, cables and underground pipes are located from the dig-safely hotline.

Improve Security

Whether you’ve purchased a used or a new home, it is a smart idea to change out the locks. As a matter a fact, consider deadbolts, which offer the most security.

Take a quick tour of your new home looking for weak areas that could provide easy access to thieves. Adding window locks, outdoor lighting and light sensors in vulnerable areas could reduce vandalism and thefts.

Electrical Panel

Locate the electrical panel in your house that contains breakers to shut off power to various parts of the home. Check to see that all breakers are labeled with the names of each room, so you’ll know which breaker to shut down in the event of an emergency.

Home Systems and Appliances

Determine whether you want to make repairs or replace home systems and appliances yourself. Perhaps you would rather purchase a home warranty from a service company that offers warranty plans to make repairs or replace faulty units.

Warranty plans can be tailored to the needs of homeowners. Many basic plans cover the major home systems like plumbing, heating, electrical and cooling. Some plans include a number of common household appliances like refrigerators, freezers and dishwashers. Generally, you pay a flat fee once a year to purchase a contract and are responsible for paying the cost of any service calls.

Checking for Plumbing Issues

Plumbing might not be much of a concern in newer homes, but you definitely want to discover plumbing problems in any used home.

Open cabinets below sinks to search for leaks. Check to see whether faucets are leaking or continually dripping. Make sure the toilet doesn’t run constantly, and look around the base of the toilets for signs of water leaks.

Insulation

It’s a smart idea to check out the attic insulation to determine if it has at least the minimum requirements to keep your home cooler in the warm months and warmer during chilly weather. Insulation should be anywhere from 10 to about 14 inches thick depending upon the type and quality of insulation.

Locate the water heater and consider purchasing an inexpensive water heater jacket if it doesn’t already have one. Also, check the settings on the water heater. Setting it to 120 degrees should more than cover your needs and may help to lower your electric bill.

Add insulation around exposed pipes in garages and basements to reduce heat loss.

Fire Prevention

Remove shrubbery and trees that are too close to the home. Maintaining a 30 foot perimeter around the home free of large bushes and trees is recommended.

Remove shrubbery and trees that are too close to the home. Maintaining a 30 foot perimeter around the home free of large bushes and trees is recommended.

Install fire alarms throughout the home. Multi-level homes should have alarms for each floor. Make sure your home is also equipped with working fire extinguishers.

There is no doubt about it, owning your first home is a learning experience. Just remember to seek advice from neighbors and when in doubt, consider calling a professional.

Bundling Insurance

If you’re wondering if you should bundle home and car insurance, the answer is almost always yes. The discounted amount from bundling home and auto always varies depending on who you are bundling with, but the average bundle discount will get you 20% off. While the immediate and obvious benefit of bundling is saving money, the benefits go beyond just savings. Because you’re bundling, there is no doubt you’ll develop a better relationship with that company as you’ll be talking to them more frequently. No yo mention you could also benefit from paying a single deductible as opposed to two.

by David Glenn | Apr 24, 2016 | CRESTICO

Most people spend their entire life working, but don’t finish their life rich. That doesn’t mean it is impossible, however, and millions of people manage to join the world’s millionaire list each year. For many, it is only after a lifetime of hard work, saving, smart investments, and job dedication. For others it happens in a stroke of good fortune, while they are still young enough to enjoy the benefits of their money.

Often the first thing people start thinking about when they come into large sums of money is their home. How are they going to build a luxury home that fulfills all their dreams and fantasies. Home building is a process and making the wrong decisions at the beginning can lead to regret and annoyance for years to come. Here are a few things to consider when building that very first luxury home.

Location, location, location

This cannot be stressed enough. The most important factor to consider is the location of the home. Do you care more about being close to family? Are you a hot or cold person? Do beaches matter, or are the mountains more inviting? Remember, this home will be customized to your tastes, so it won’t be as easy to sell as you would like to think. Choose the right location and enjoy years of no regrets.

Size

Many people think that all they care about is having a big home, only to be disappointed when they are not happy in their extremely large home and don’t like the empty feeling that occasionally accompanies it. Figure out everything that the home should have, then choose a size that can accommodate the things you would like as well as the number of people you would like to host. For some, they don’t feel comfortable with more than 5-10 people in their home at once anyway, so why built a mansion?

Style

Choose a consistent style throughout the home. Spend a significant amount of time doing research online, in home tours, and on Pinterest and find the style that can suit you for years to come.

Entertainment

The best part of a luxury home room is often the entertainment. Have you always wanted a home theater? A game room with ping pong and pool? Or an indoor hot tub and pool combo that comes with a waterslide? Maybe all three appeal to you. Spend some time deciding if you want each one, and do research so you know what you are getting into. Pools are great, but require maintenance. Theaters are fun, but you may not like yours, or others kids using it constantly.

Kitchen

The kitchen is one of the most important places in your new luxury home. You’ll be there multiple times each day and things need to be perfect. Think about where you want everything to go, how many people will be eating and cooking in the kitchen. If you plan on celebrating Thanksgiving with family in your new luxury home make sure the kitchen is built to accommodate. One of the most frustrating aspects of most kitchens is the lack of space. Make sure there are plenty of cupboards, nooks, and spaces for any appliance you may purchase in the long future.

Bathroom

The next most important thing is the bathroom. Bathrooms can be a place of comfort, despite what you may remember from previous low-budget houses. Think jacuzzis, soft rugs, multiple shower heads, and relaxation. Your bathroom can provide all of these.

It’s a great time in life if these are all options for you. You’ve likely had hard times in the past and have looked forward to this a large majority of your life. Enjoy every minute of it.

Remove shrubbery and trees that are too close to the home. Maintaining a 30 foot perimeter around the home free of large bushes and trees is recommended.

Remove shrubbery and trees that are too close to the home. Maintaining a 30 foot perimeter around the home free of large bushes and trees is recommended.