If you are at the same time excited and terrified at the prospects of purchasing your first house, don’t worry, you are not the only one. This is probably the largest financial venture you will undertake so it is natural to be a bit nervous and to wish to research everything in detail so you can feel comfortable as much as possible. With that in mind, here is a list of certain expenses you need to keep in mind when you are planning the budget for your first home.

Prepare for the down payment

Everyone who has purchased a house, vehicle or other more expensive asset had to prepare for the down payment. It represents a portion of your new house’s price which is paid upfront and it can go up to 20 percent of that sum. For instance, if the house costs $200,000, the down payment would be $40,000 and if you saved up that amount, that means that you would have to acquire another $160,000 through a bank loan or some other financial scheme. Both your savings and the manner you would obtain the rest of the sum is something you need to plan for in advance to make sure you come up with the optimal solution when it comes to monthly installments and the length of the payment period.

Keep in mind the house insurance

Taking out home and contents insurance is a small pre-purchase step which could mean a lot in case something happens. One of the most important features you should pay attention to is the 24/7 assistance, while others that could be of use include temporary accommodation in case the damage is substantial and counseling after a traumatic event. The insurance costs vary varies from property to property, and you can click here for home and contents insurance reviews to get more familiar with the conditions and choose the option which would suit you the most. Some things you need to ensure your new home and belongings against are fire, earthquake, storm, flood, and make sure you read the small print and to know exactly what is covered by the insurance.

Anticipate building inspection costs

Since you are buying a house for the first time, you probably don’t have much experience with assessing the offer and there is a reasonable fear among many people when they start looking for the first property that they might overpay for a place. This is why building inspection is a perfect manner to check the structural soundness so you don’t pay too much for a house that is essentially better to be knocked down and built again. These inspections usually cost up to $600 which is not a big amount, considering that it gives you peace of mind regarding a long-term investment that is much larger.

Don’t forget the moving expenses

In all the commotion regarding finding the perfect place and arranging the finances to purchase it, many people forget about moving. Since your belongings won’t magically appear in your new home, you need to take it very seriously, as well as the incurred expenses. Besides a lot of hard work related to decluttering, organizing items and cleaning the place, you will need packing supplies and a truck or a moving crew to transfer your things to the new place. Also, some people go for moving insurance, just to make sure they are safe if anything gets broken or damaged during a move, which is not impossible, having in mind the amount of (semi)fragile belongings that you might have.

When you think you’ve found your dream house, before saying ‘I do’ to it, sit and think about all the expenses and plan your budget well so you can make sure that you having everything under control. That is the only manner you will be able to truly enjoy your new house and to consider it ‘home sweet home’.

As your retirement date approaches, you may be actively moving forward with plans to prepare for retirement. For example, you may be researching low cost health insurance options for retirees or making an effort to transition your spending so that it is more in line with your fixed retirement budget. One of the most significant factors that retirees consider is what to do with their housing situation. More specifically, should you move into a new home or remodel your current home so that it meets your current and future needs? Future needs, for example, may include transitioning from a two-story home to a one-story home with handicap accessible features. There is no right answer to this important housing question, and retirees should carefully review the two options available to determine what is best for them. By focusing on a few points, you may realize that one option is more clearly aligned with your goals and objectives than the other.

The Financial Aspect

There are numerous financial factors to consider when you determine which location is most affordable to live in. For example, when comparing two separate homes, you may analyze factors like the mortgage expense as well as property taxes, insurance and utilities costs. However, the cost of living in an area, state and local income tax and even estate taxes may also play a role in where you choose to live. In addition to these points, consider how you plan to spend your days in retirement, and you may find that it is more cost effective to live in certain areas to enjoy your daily activities. For example, if you plan to travel, living close to an international airport or a popular cruise port may be financially advantageous. If you plan to golf, living in an area that has dozens of golf courses close by may be beneficial. Remodeling your home locks you into living in your current location, but there may be benefits associated with relocating to a new area.

Intangible Benefits

There are also intangible aspects associated with remodeling or relocating. Many retirees may have spent long years or even decades in their current home. They may have many friends and neighbors in the community that they would have to say goodbye to if they move far away. They may also have significant memories of kids growing up and major life events that occurred while living in the home. While some people may have trouble emotionally detaching from a home, some may also have trouble remodeling their home for these same reasons. If you are trying to decide between moving or relocating, consider the fact that the emotional upheaval of a major remodeling project can be just as traumatic as a full relocation.

The Risks and Downsides

While there may be financial advantages and intangible advantages associated with both relocating and remodeling, there also may be many risks and downsides to consider. For example, if you choose to remodel your home, you may have to deal with personal injury lawsuits from poorly selected contractors or even shoddy workmanship that affects your property value. If you choose to sell your home and relocate, you may have to contend with unexpected repair work on the new home that you have not budgeted for. These are only a few of the potential risks and downsides associated with relocating to a new home, and you should fully research all possibilities before you make a final decision about how to proceed.

One of the toughest decisions you will have to make when preparing for retirement is choosing where to live. With so many different options available to you, it can be difficult to narrow down the options and to make a wise, informed decision. As you explore the living options for your retirement years in greater detail, focus on each of these points to help you eliminate options that may not be best suited for you.

Decorating an apartment can be a bit of a puzzler, especially if you’re renting. On top of this, if you’re a struggling college student, not only are you limited in your choices but you’re probably limited on funds. So here are a few great tips for decorating your apartment on a budget.

Wall Decals

These things are a genius invention. Wall Decals don’t require nails or paint and are perfect for a rental space. You don’t just have to pick from a life-inspiring quote, either. Today there are wall stickers that are complete murals or even wallpaper. Not only are these a cheap alternative to fixing holes or painting, they are also so easy to apply and even easier to take down. And they don’t leave a mess.

Next to wall decals are furniture decals. You can stick a fun polka dot sticker sheet on a desk, fridge or cabinets and really spunk up your place without spending an arm and a leg. Or even too much time. If you have a bit more money ask your apartment manager if you’re allowed to get some etched glass. Installing etched glass can really change the look of an apartment and add an upscale feel, the only downside is it is expensive.

Build It

Furniture can become extremely expensive. But rather than paying an arm and a leg, you can easily learn how to build pieces yourself. Try building your own desk, bookshelf or even closet doors. There are many great how-to’s to follow and many lumber yards will sell wood for pretty cheap if you buy directly from them. You can even do this for a stunning headboard for your bed. If you plan to cover the headboard in fabric, then you can easily pay for inexpensive hardwood for underneath.

Buy Good, Not Price

Rita Konig, interior designer and European Editor for The Wall Street Journal’s WSJ, says that “it’s easy to buy things for the price, rather than buy good things. But if you guy good things, they will always be with you. If you buy the bad couch, for instance, you will always want to replace it as soon as you can.” It’s kind of like clothing, you can buy a new pair of $12 jeans every six months or spend $40 to $60 and have a pair that last a few years or even longer. This may mean that you only have a few key pieces while you slowly build up your collection.

Reupholster

Konig and Emily Henderson, host of Secrets From a Stylist, both suggest that you focus more on the shape of a piece of furniture rather than the fabric as you can buy a cheaper couch and easily reupholster it. By doing this you could end up spending less to buy and reupholster a couch rather than paying for one that is all around perfect.

Another thing to keep in mind while reupholstering is that it doesn’t need to be super expensive. Instead of spending lots of money on expensive cleaning supplies start to research things you already own that you can use to help you out. For instance I found out that some lemon juice, white vinegar, and refined coconut oil can be used to polish wood furniture, so I went out, bought some old wood tables and chairs and cleaned and polished them up to shape. I ended up with furniture that looked new at less than ten percent of the cost.

Re-envision

Jamie Drake of Drake/Anderson says to first start by re-envisioning your place before spending any money. Flip a floor plan, move a piece into a different room, reupholster or spray wood pieces. This can be one of the most inexpensive ways to decorate your apartment.

Do-it-Yourself

Sew your own quilt or comforter. Make your own throw pillows. Paint your own art. There are so many great projects out there that you can learn to do yourself that you could practically decorate your entire apartment with the talent of your own hands!

Repurpose

If you can’t go buy brand new furniture at the moment or don’t want to throw something out, try repurposing a few pieces. You can turn a mismatched or rickety chair into a great bedside table. Or take an old duvet or comforter and repurpose it into a pet’s cozy sleeping spot. Turn an old door into a tabletop, old curtains into napkins, and so much more. You can even turn no-longer-used sheets into light and airy window treatments. The possibilities are endless!

Buying a home is a pretty big step in our lives. And knowing just what to do, how to do it, or everything that you need to do can get tricky and confusing. There a lot of people who will give you a lot of advice, but there are just a few that you should definitely pay attention to. We’ve rounded them up for you here to make that transfer from potential buyer to homeowner.

Homeowner’s Insurance

This is a big one. Homeowner’s insurance is one of the most important things that you can invest in for your new house. This insurance, like all insurance, is meant to keep you and your family and property safe from any potential damage or situations that occur.

Along with homeowner’s insurance, investing in a home warranty plan is also a very handy and important addition to your new space. A home warranty plan is a great way to keep your home systems, appliances, and so much more safe from the everyday wear and tear that comes from home life and from those “rainy days,” like a flooded basement, electrical fires, or just rambunctious guests or kids.

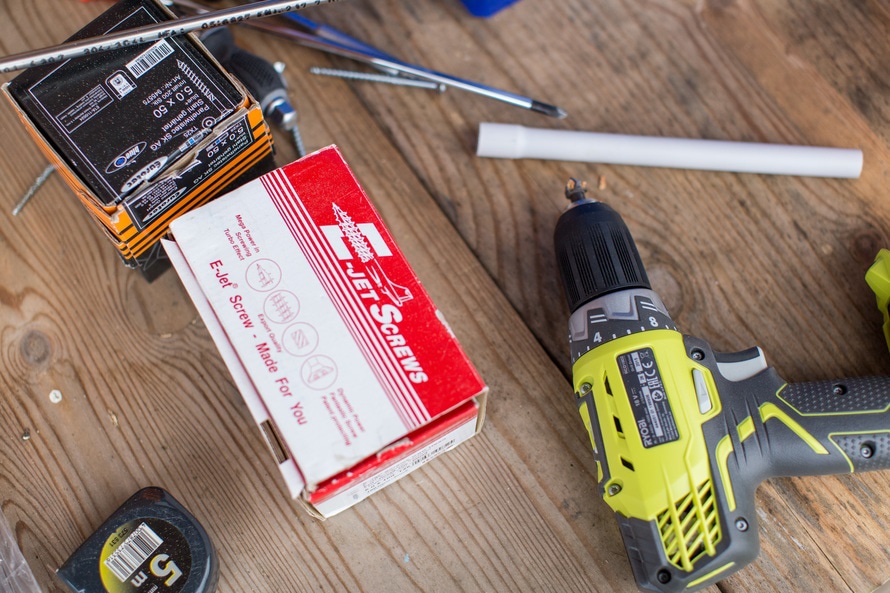

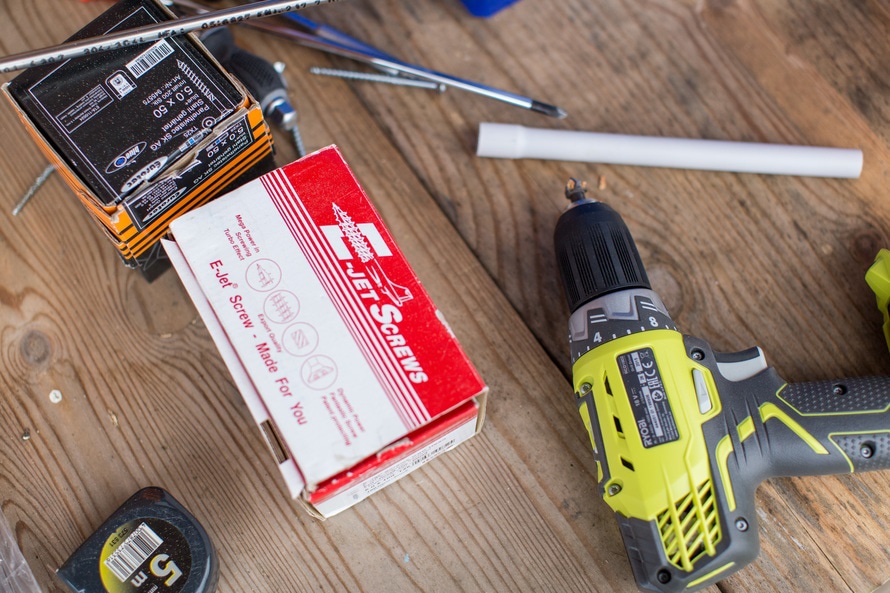

DIY Fixes

As a homeowner, unless you’re rolling in the dough, a great thing to do is learn how to do typical home maintenance and fixes yourself. Hiring a professional for every break, scrape, tear, leak, and more can really add up. Learning and teaching yourself how to do the basics can help you save so much in the long run. As a homeowner you need to become a bit of a “handyman.” You now own the space and don’t have a manager to rely on to take care of every clogged toilet or rouge ant parade in your home.

There are a lot of resources out there that can help you walk through how-to’s on fixing typical repairs around the house. You can check out DIY fixing websites or even Pinterest boards to help expand your new skill sets.

Home Maintenance

If you’re not buying a brand new home or building, there are a few things you should definitely do when you move into your new home.

Change the locks. Though the past homeowners may have given you all the keys they have, there might be a rogue cousin or neighbor who still has a set or two and you don’t want to run any risks. Install new deadbolts and even handle locks. You can do this for less than $10 per lock, or you can call a locksmith to have it down professionally. If you supply the new locks, the locksmith will generally only charge about $20 to $30 per lock for labor.

Check the insulation in the attic. If there isn’t enough, install more. This can actually be a money-saver tip too. There should be at least six inches of it everywhere. If it looks damaged, replace it too. A few other great things to do is to check for pipe leaks, replace air filters, clean out vents, air-seal the house, steam clean the carpets, spray for insects and pests, and check the breaker panel and outlets.

These are all great things to do before you move all of your furniture and personal belongings in. They are also things that might have gone unnoticed in an inspection. Once you do a good once-through of the house, start a brand new home maintenance checklist. You can find a template online. This will help you know when to change out smoke alarm batteries, air filters, and to service any home systems. Staying up-to-date on your home maintenance can help you to avoid any big repairs or disasters in the future.

Being Married to Your Mortgage

Too many homeowners think about their house as an investment instead of a cost-of-living. Your house is not an investment unless you can afford to give it up! This is not the case with most homeowners. Prior to getting a mortgage you should prepare to be spending a large sum of your monthly income, but not every penny. You want owning a home to be an experience that enhances your freedom, not restrict it. If you’re spending every earned penny on your mortgage then very little will be left over for desired non essentials that are still important. For instance, Weekend getaways, eating out with friends, Tour groups, and more. You should be able to have enough for a car or appliance break down (a rainy day fund) and then a little left over for the nice things in life.

Section 129B(d) of TILA, as added by the Dodd-Frank Act, permits consumers to bring actions against individual mortgage loan originators for violations of certain provisions of TILA. For example, while LO’s can be held personally liable for receiving compensation in violation of the Rule, they are not personally liable under TILA/LO Comp for failing to maintain the records of compensation required by the rule. The LO Comp Rule, which implements the DFA’s statutory authority confirms this personal liability through its changes to Reg. Z’s definitions. Specifically, the change to § 1026.36 (a)(1)in the LO Comp Rule clarifies the definition of “loan originator” to mean either the individual LO or the company. The following is from the CFPB’s small business compliance guide which seeks to use plain language explanations for the Rule (although it still warns you that you need to see the actual Rule for details): “A “loan originator” is either an “individual loan originator” or a “loan originator organization.” “Individual loan originators” are natural persons, such as individuals who perform loan origination activities and work for mortgage brokerage firms or creditors. “Loan originator organizations” are generally loan originators that are not natural persons, such as mortgage brokerage firms and sole proprietorships”

TILA is confusing for a lot of reasons, but one of the biggest areas of confusion in the LO Comp and Ability to Repay rules are the differing obligations imposed on “Creditors”, “Loan Originators”, and “Loan Originator Organizations”. These definitions are critical in determining who is responsible for any obligation under TILA. LO comp is one of the few times where the obligation extends all the way down to the individual LO, but the liability is potentially huge. I don’t know about the issue from the LO’s perspective (ask an attorney; see below) – does the borrower have a life of loan defense? As best I understand it, the life of loan defense is true as it relates to foreclosure but the remedy is not a free house, it is three years of interest and other fees (loan, attorney) – a monetary judgment. So there shouldn’t be any runs on any particular company.

Attorney Brad Hargrave (MedlinHargrave) writes, “Loan originator compensation is one area of Truth in Lending and Regulation Z wherein someone other than a creditor; namely, the loan originator, can also be held liable for a violation. The citation in support of this proposition is found at 15 USC §1639b(d)(1) which provides, in pertinent part, that ‘for purposes of providing a cause of action for any failure by a mortgage originator, other than a creditor, to comply with any requirement under this section, and any regulation prescribed under this section, section 1640 shall be applied with respect to any such failure by substituting ‘mortgage originator’ for ‘creditor’ each place such term appears in each such subsection.’ And, §1640 is that section of TILA that imposes civil liability for various TILA violations, including those sections regarding LO Compensation. (I have not addressed the recoupment and setoff issues in the event of foreclosure in the context of the LO, given that an LO would not be the party initiating the foreclosure; and thus, this section really isn’t applicable to an LO).”

Mr. Hargrave’s note continues, “The penalties are potentially severe. In an individual civil action brought by a consumer, the creditor who paid the violative compensation could be liable to the borrower for actual damages, plus twice the amount of any finance charge in the transaction (capped at $4,000), plus an amount equal to the sum of all finance charges and fees paid by the consumer (unless the creditor can demonstrate that the failure to comply is not material), plus reasonable attorneys’ fees and court costs if the borrower were to prevail. The loan originator’s exposure to such a claim (per 15 USC § 1639b(d)(2))is the greater of actual damages to the consumer or three times the total amount of direct and indirect compensation paid to the LO in connection with the subject loan, plus the costs to the consumer of the action, including reasonable attorneys’ fees. In addition, the CFPB could sue the creditor and the loan originator in Federal District Court and seek any one of a number of remedies, including restitution and/or disgorgement, and appropriate injunctive relief, as to all loans wherein the LO received unlawful compensation. It is also possible that the matter could be referred to another agency for enforcement.”