by David Glenn | May 27, 2016 | CRESTICO

Buying a home is a pretty big step in our lives. And knowing just what to do, how to do it, or everything that you need to do can get tricky and confusing. There a lot of people who will give you a lot of advice, but there are just a few that you should definitely pay attention to. We’ve rounded them up for you here to make that transfer from potential buyer to homeowner.

Homeowner’s Insurance

This is a big one. Homeowner’s insurance is one of the most important things that you can invest in for your new house. This insurance, like all insurance, is meant to keep you and your family and property safe from any potential damage or situations that occur.

Along with homeowner’s insurance, investing in a home warranty plan is also a very handy and important addition to your new space. A home warranty plan is a great way to keep your home systems, appliances, and so much more safe from the everyday wear and tear that comes from home life and from those “rainy days,” like a flooded basement, electrical fires, or just rambunctious guests or kids.

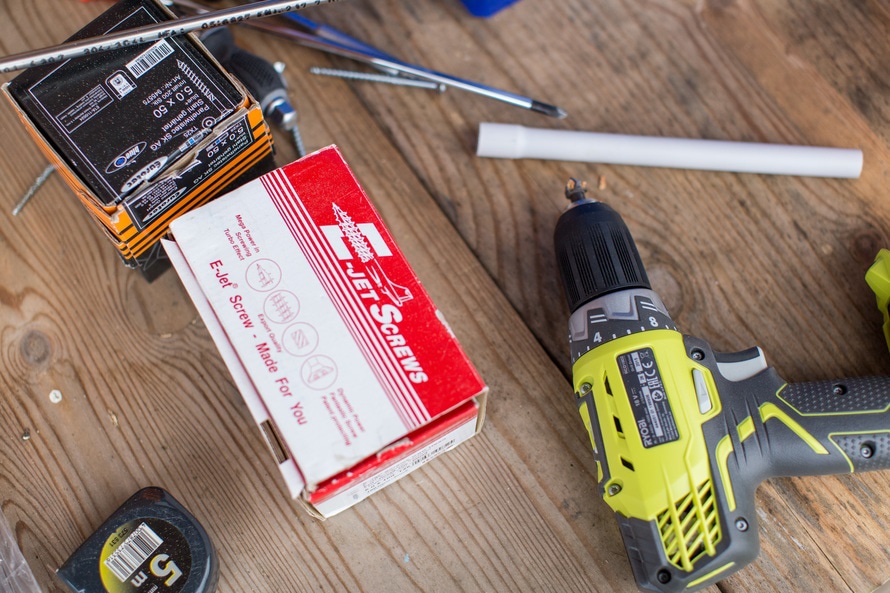

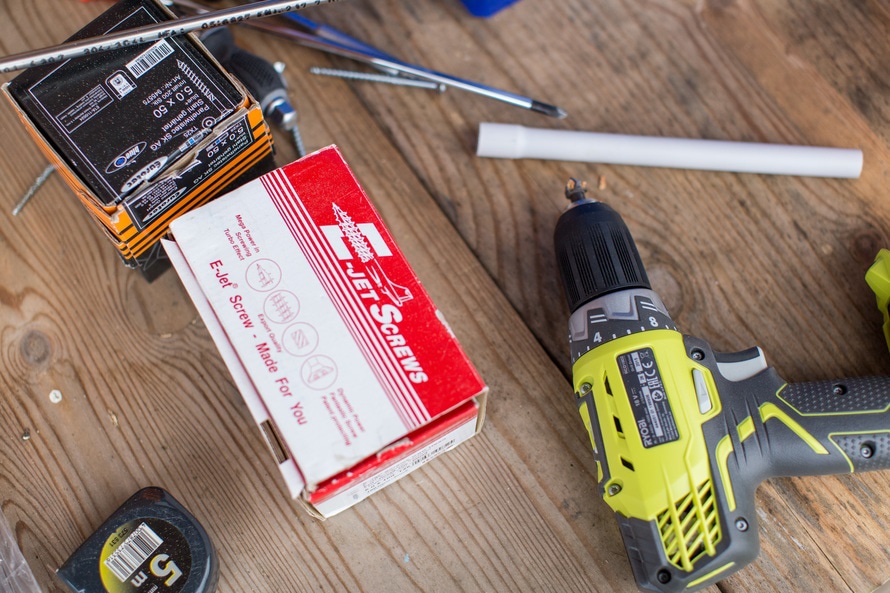

DIY Fixes

As a homeowner, unless you’re rolling in the dough, a great thing to do is learn how to do typical home maintenance and fixes yourself. Hiring a professional for every break, scrape, tear, leak, and more can really add up. Learning and teaching yourself how to do the basics can help you save so much in the long run. As a homeowner you need to become a bit of a “handyman.” You now own the space and don’t have a manager to rely on to take care of every clogged toilet or rouge ant parade in your home.

There are a lot of resources out there that can help you walk through how-to’s on fixing typical repairs around the house. You can check out DIY fixing websites or even Pinterest boards to help expand your new skill sets.

Home Maintenance

If you’re not buying a brand new home or building, there are a few things you should definitely do when you move into your new home.

Change the locks. Though the past homeowners may have given you all the keys they have, there might be a rogue cousin or neighbor who still has a set or two and you don’t want to run any risks. Install new deadbolts and even handle locks. You can do this for less than $10 per lock, or you can call a locksmith to have it down professionally. If you supply the new locks, the locksmith will generally only charge about $20 to $30 per lock for labor.

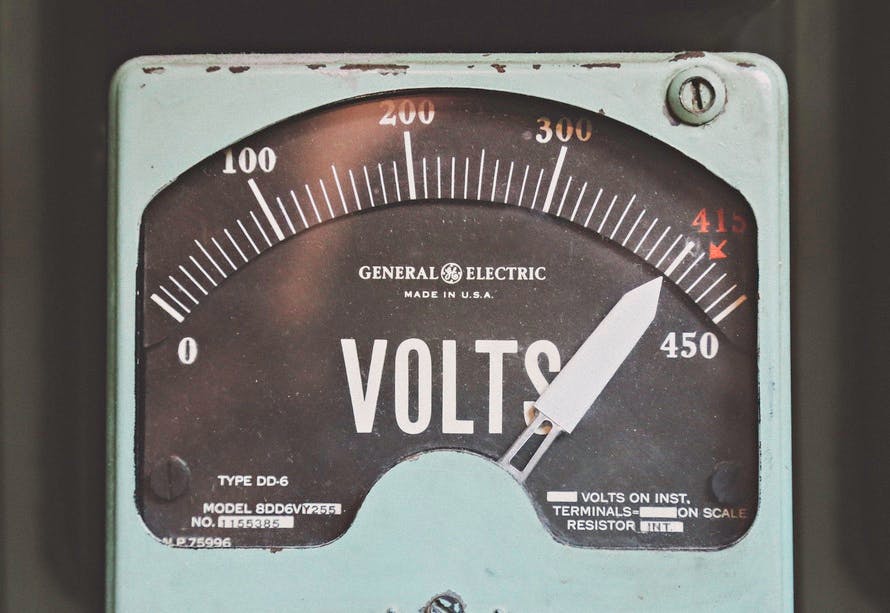

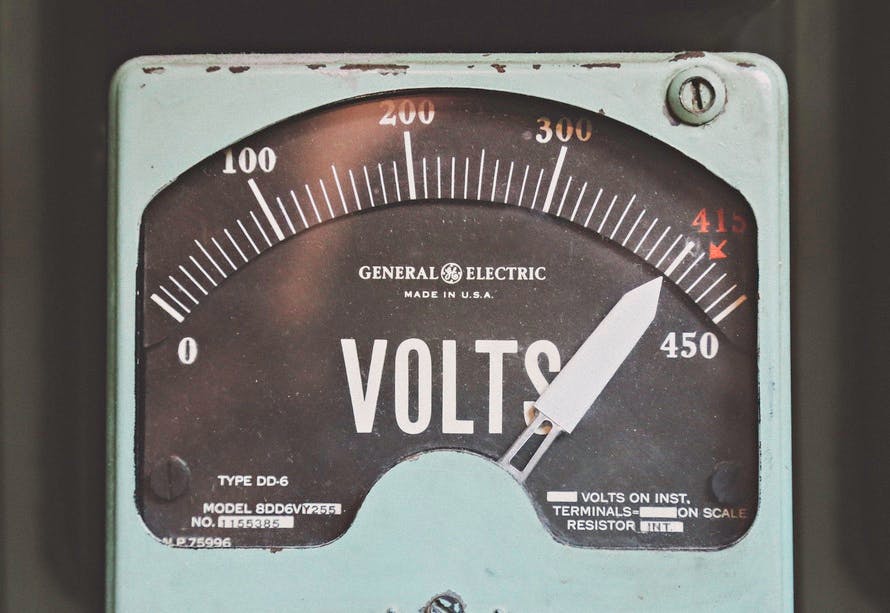

Check the insulation in the attic. If there isn’t enough, install more. This can actually be a money-saver tip too. There should be at least six inches of it everywhere. If it looks damaged, replace it too. A few other great things to do is to check for pipe leaks, replace air filters, clean out vents, air-seal the house, steam clean the carpets, spray for insects and pests, and check the breaker panel and outlets.

These are all great things to do before you move all of your furniture and personal belongings in. They are also things that might have gone unnoticed in an inspection. Once you do a good once-through of the house, start a brand new home maintenance checklist. You can find a template online. This will help you know when to change out smoke alarm batteries, air filters, and to service any home systems. Staying up-to-date on your home maintenance can help you to avoid any big repairs or disasters in the future.

Being Married to Your Mortgage

Too many homeowners think about their house as an investment instead of a cost-of-living. Your house is not an investment unless you can afford to give it up! This is not the case with most homeowners. Prior to getting a mortgage you should prepare to be spending a large sum of your monthly income, but not every penny. You want owning a home to be an experience that enhances your freedom, not restrict it. If you’re spending every earned penny on your mortgage then very little will be left over for desired non essentials that are still important. For instance, Weekend getaways, eating out with friends, Tour groups, and more. You should be able to have enough for a car or appliance break down (a rainy day fund) and then a little left over for the nice things in life.

by David Glenn | May 9, 2016 | CRESTICO

In all likelihood, if you’ve been living with your folks, in a dorm room or an apartment, you probably don’t know a whole lot about home maintenance, landscaping or home security. These tips may help to prevent costly mistakes, save money and help you to learn about homeowner responsibilities.

Valve for Water Shutoff

After purchasing a new or used home, you need to locate the main valve for shutting off the water to the home in an emergency. Shutoff valves are typically located near the water main where it comes into the home. Everyone living in the home should understand how to turn the valve off.

You may need to shut the valve off when pipes burst or an overflowing toilet floods the floors, carpeting, cabinets or wallboards. These items are difficult to dry out and can lead to costly repairs.

Landscaping

Planting new or additional landscaping is a wonderful way to add a bit of your own personality to the home, and it can help to keep your home much cooler during hot summer weather.

Choose trees and vines to plant on the southern and western sides of the home, which will provide much needed shade. Call 811 before you begin digging around your home to learn where wires, cables and underground pipes are located from the dig-safely hotline.

Improve Security

Whether you’ve purchased a used or a new home, it is a smart idea to change out the locks. As a matter a fact, consider deadbolts, which offer the most security.

Take a quick tour of your new home looking for weak areas that could provide easy access to thieves. Adding window locks, outdoor lighting and light sensors in vulnerable areas could reduce vandalism and thefts.

Electrical Panel

Locate the electrical panel in your house that contains breakers to shut off power to various parts of the home. Check to see that all breakers are labeled with the names of each room, so you’ll know which breaker to shut down in the event of an emergency.

Home Systems and Appliances

Determine whether you want to make repairs or replace home systems and appliances yourself. Perhaps you would rather purchase a home warranty from a service company that offers warranty plans to make repairs or replace faulty units.

Warranty plans can be tailored to the needs of homeowners. Many basic plans cover the major home systems like plumbing, heating, electrical and cooling. Some plans include a number of common household appliances like refrigerators, freezers and dishwashers. Generally, you pay a flat fee once a year to purchase a contract and are responsible for paying the cost of any service calls.

Checking for Plumbing Issues

Plumbing might not be much of a concern in newer homes, but you definitely want to discover plumbing problems in any used home.

Open cabinets below sinks to search for leaks. Check to see whether faucets are leaking or continually dripping. Make sure the toilet doesn’t run constantly, and look around the base of the toilets for signs of water leaks.

Insulation

It’s a smart idea to check out the attic insulation to determine if it has at least the minimum requirements to keep your home cooler in the warm months and warmer during chilly weather. Insulation should be anywhere from 10 to about 14 inches thick depending upon the type and quality of insulation.

Locate the water heater and consider purchasing an inexpensive water heater jacket if it doesn’t already have one. Also, check the settings on the water heater. Setting it to 120 degrees should more than cover your needs and may help to lower your electric bill.

Add insulation around exposed pipes in garages and basements to reduce heat loss.

Fire Prevention

Remove shrubbery and trees that are too close to the home. Maintaining a 30 foot perimeter around the home free of large bushes and trees is recommended.

Remove shrubbery and trees that are too close to the home. Maintaining a 30 foot perimeter around the home free of large bushes and trees is recommended.

Install fire alarms throughout the home. Multi-level homes should have alarms for each floor. Make sure your home is also equipped with working fire extinguishers.

There is no doubt about it, owning your first home is a learning experience. Just remember to seek advice from neighbors and when in doubt, consider calling a professional.

Bundling Insurance

If you’re wondering if you should bundle home and car insurance, the answer is almost always yes. The discounted amount from bundling home and auto always varies depending on who you are bundling with, but the average bundle discount will get you 20% off. While the immediate and obvious benefit of bundling is saving money, the benefits go beyond just savings. Because you’re bundling, there is no doubt you’ll develop a better relationship with that company as you’ll be talking to them more frequently. No yo mention you could also benefit from paying a single deductible as opposed to two.

by David Glenn | Apr 21, 2016 | CRESTICO

Home trends change from year to year, but overall, home ownership is a beautiful thing. You have a place to call your own while building up equity in your investment. And there’s also something about owning your home yourself rather than renting it from someone else. Investing in your home most likely will bring a great return, so the following are a few tips from the pros as you look at what your home needs next.

- Getting back to nature

The down-to-earth vibe is here to stay for a while. Designers and homeowners are loving the clean, Nordic design look cozied up with natural pine flooring and furnishings, soft textures like shearling, hides and fur with the occasional pop of color. Dark shades of green (as in, deep jungle, forest and olive tones) and nuances of ocean hues (blue-green, lime, jade, and cobalt)are on the horizon as some of the top color trends for the coming year. Of course, strategically placed indoor plants (trend alert: olive plants and trees!) lend a touch of green to enliven a space.

- Dedicated, technology-free space in floor plans

As open concept design and technology evolve, homeowners are increasingly looking for a small place to escape to where technology is absent. A bedroom nook, library or entry alcove along with warm, enveloping furnishings provides the perfect retreat from the barrage of screen information most homeowners face daily. Early in the design process is the best time to nail down exactly where and how to carve out a peaceful sanctuary within your home.

- Natural Textures

For furniture design, cane, rattan and abaca have been reinvented with a modern flair. Cork, a fast-growing and renewable resource, is emerging as a strong sound buffer for the pervasive open floor plan. Think a side or coffee table, stool or even an entire wall in a home office. Cork’s warmth and renewability make it a top choice for 2017 homeowners. Terra cotta tiles are also on the upswing with a new matte finish that stays away from the rustic feel of previous years. Look for terra cotta to influence fireplace surround design and bathroom design.

- Art-inspired wallpaper

After years of removing wallpaper, homeowners and designers are now considering its many benefits. In addition to many up-and-coming designs in today’s marketplace, artists can now turn their work into wallpaper murals by enlarging their art to a grand scale. Area Environments is one such studio that has seen a rise in demand for art-inspired wallpaper and creates impressive wallscapes.

- Black as a staple kitchen design element

White as a preferred design element is slowly being upstaged by its direct opposite. Black cabinets, countertops, appliances and more are coming into their own as designers seek a warmer, sleeker silhouette. As the perfect foil for metals, plants and colorful food, black seems to be coming into its own. If homeowners aren’t sure about a full-on black kitchen, dark gray and strategically designed black and white layouts are growing in popularity worldwide.

- Fair realtor fees

Too often realtors are given their set fees automatically without any direct correlation to the quality of service they have provided. With housing prices possibly leveling off in late 2017, homeowners who are considering selling need to get top dollar without costly realtor fees. A popular option is a flat fee MLS listing service. Basically, this is a Real Estate broker offering to list the property for a flat fee rather than a percentage of the sale price. There are some additional details to consider before deciding if this option is the right one for you, but typically a successful property sale in this scenario results in a seller saving half of the traditional commission and retaining the right to sell on his or her own.

Your home is typically one of your biggest investment over your lifetime. Make it a great space to retreat to, play in and even sell when the time is right.

by CRESTICO | Dec 5, 2013 | CRESTICO, Mortgage, Real Estate

Distressed California Homeowners May Qualify for California’s Keep Your Home California Transition Assistance Program (TAP)

If your financially distressed California clients can no longer afford their homes and are pursuing a short sale or a deed in lieu of foreclosure, they may be eligible for financial help with their relocation to alternative housing.

The funds come from the Transition Assistance Program (TAP), part of the Keep Your Home California Program.

The state of California is providing up to $5,000 in transition assistance to qualified homeowners who can no longer afford to stay in their homes. You can help by advising your distressed clients that they must:

- Apply for the funds through their state’s website or by calling 1.888.954.5337.

- Maintain their property until their house is sold or returned to the lender via a negotiated deed in lieu of foreclosure.

For qualified homeowners, these state funds may be used in addition to any other transition assistance that the homeowner may receive by participating in the Federal Home Affordable Foreclosure Alternatives (HAFA) program or in any other pre-offer short sale program.

To learn more about the Transition Assistance Program’s guidelines, and how your clients may qualify, please visit that program’s website at http://keepyourhomecalifornia.org. You can also direct your clients to call 1.888.954.5337 and identify themselves as Bank of America customers

by CRESTICO | May 21, 2012 | CRESTICO

73% of homeowners are paying too much for their home insurance! Let me tell you about three easy things you can do today to cut down your cost:

#1 – Give them more business and reap the rewards! – By combining your auto and home (or boat, motorcycle, RV, business, life, etc) policies with the same insurance company they will reward you with a multi-policy discount. If your insurance company doesn’t offer you this discount then chances are I can beat your current policies.

#2 – Cut the middleman out – Brokers make their money by charging a brokerage fee and they add that fee to your costs. By switching to a private insurance agent, you can cut out the brokerage fee and save yourself some additional money.

#3 – Discounts, Discounts, Discounts!!! – By installing a burglar fire alarm in your home you can save up to 20% off your policy. You can also get discounts for dead-bolt locks, indoor fire sprinklers, and even smoke detectors (which you should have anyways). If you currently aren’t offered these discounts, check with me to see what I can do for you.

Remove shrubbery and trees that are too close to the home. Maintaining a 30 foot perimeter around the home free of large bushes and trees is recommended.

Remove shrubbery and trees that are too close to the home. Maintaining a 30 foot perimeter around the home free of large bushes and trees is recommended.