In all likelihood, if you’ve been living with your folks, in a dorm room or an apartment, you probably don’t know a whole lot about home maintenance, landscaping or home security. These tips may help to prevent costly mistakes, save money and help you to learn about homeowner responsibilities.

Valve for Water Shutoff

After purchasing a new or used home, you need to locate the main valve for shutting off the water to the home in an emergency. Shutoff valves are typically located near the water main where it comes into the home. Everyone living in the home should understand how to turn the valve off.

You may need to shut the valve off when pipes burst or an overflowing toilet floods the floors, carpeting, cabinets or wallboards. These items are difficult to dry out and can lead to costly repairs.

Landscaping

Planting new or additional landscaping is a wonderful way to add a bit of your own personality to the home, and it can help to keep your home much cooler during hot summer weather.

Choose trees and vines to plant on the southern and western sides of the home, which will provide much needed shade. Call 811 before you begin digging around your home to learn where wires, cables and underground pipes are located from the dig-safely hotline.

Improve Security

Whether you’ve purchased a used or a new home, it is a smart idea to change out the locks. As a matter a fact, consider deadbolts, which offer the most security.

Take a quick tour of your new home looking for weak areas that could provide easy access to thieves. Adding window locks, outdoor lighting and light sensors in vulnerable areas could reduce vandalism and thefts.

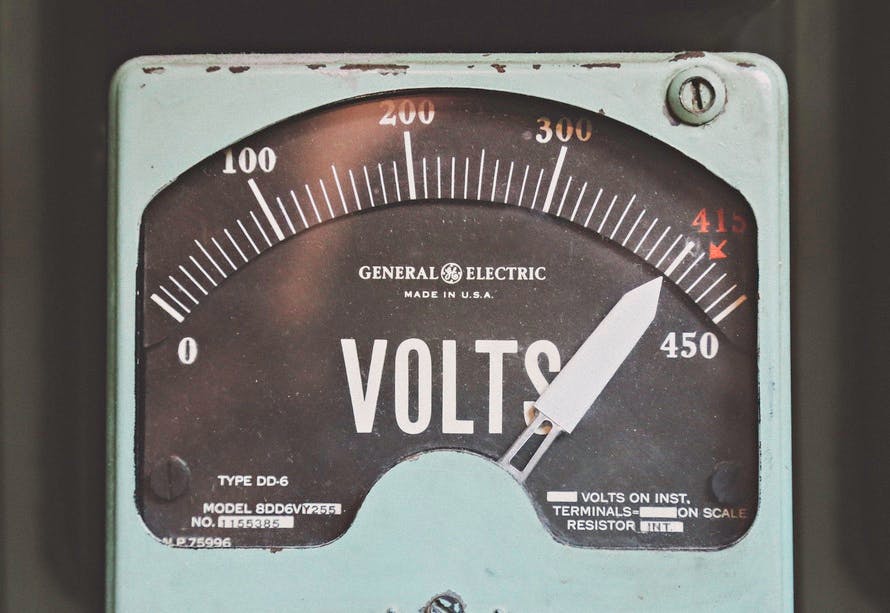

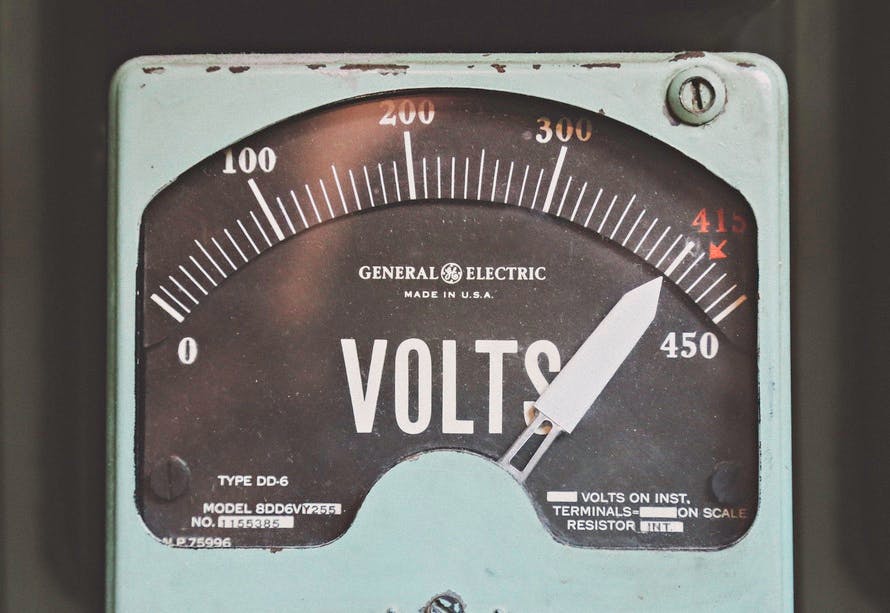

Electrical Panel

Locate the electrical panel in your house that contains breakers to shut off power to various parts of the home. Check to see that all breakers are labeled with the names of each room, so you’ll know which breaker to shut down in the event of an emergency.

Home Systems and Appliances

Determine whether you want to make repairs or replace home systems and appliances yourself. Perhaps you would rather purchase a home warranty from a service company that offers warranty plans to make repairs or replace faulty units.

Warranty plans can be tailored to the needs of homeowners. Many basic plans cover the major home systems like plumbing, heating, electrical and cooling. Some plans include a number of common household appliances like refrigerators, freezers and dishwashers. Generally, you pay a flat fee once a year to purchase a contract and are responsible for paying the cost of any service calls.

Checking for Plumbing Issues

Plumbing might not be much of a concern in newer homes, but you definitely want to discover plumbing problems in any used home.

Open cabinets below sinks to search for leaks. Check to see whether faucets are leaking or continually dripping. Make sure the toilet doesn’t run constantly, and look around the base of the toilets for signs of water leaks.

Insulation

It’s a smart idea to check out the attic insulation to determine if it has at least the minimum requirements to keep your home cooler in the warm months and warmer during chilly weather. Insulation should be anywhere from 10 to about 14 inches thick depending upon the type and quality of insulation.

Locate the water heater and consider purchasing an inexpensive water heater jacket if it doesn’t already have one. Also, check the settings on the water heater. Setting it to 120 degrees should more than cover your needs and may help to lower your electric bill.

Add insulation around exposed pipes in garages and basements to reduce heat loss.

Fire Prevention

Remove shrubbery and trees that are too close to the home. Maintaining a 30 foot perimeter around the home free of large bushes and trees is recommended.

Remove shrubbery and trees that are too close to the home. Maintaining a 30 foot perimeter around the home free of large bushes and trees is recommended.

Install fire alarms throughout the home. Multi-level homes should have alarms for each floor. Make sure your home is also equipped with working fire extinguishers.

There is no doubt about it, owning your first home is a learning experience. Just remember to seek advice from neighbors and when in doubt, consider calling a professional.

Bundling Insurance

If you’re wondering if you should bundle home and car insurance, the answer is almost always yes. The discounted amount from bundling home and auto always varies depending on who you are bundling with, but the average bundle discount will get you 20% off. While the immediate and obvious benefit of bundling is saving money, the benefits go beyond just savings. Because you’re bundling, there is no doubt you’ll develop a better relationship with that company as you’ll be talking to them more frequently. No yo mention you could also benefit from paying a single deductible as opposed to two.

There are more than enough things that homeowners assume they know, yet aren’t fully aware of. Letting things slip under the carpet or become easily forgotten can create more work than you realize. Knowing just what you need to be aware of to keep your home functioning well and always being on top of repairs is one of the biggest jobs of a homeowner. Here are seven things every homeowner should know.

Regular Filter Replacement

Replacing filters, especially for your furnace, on a regular basis is very important if you want to keep your appliances in the best condition. Ideally, they should be changed four times a year. If this feels like excessive, at least do it twice a year. To make it easy, buy several filters at once and label them with the month that you plan on changing them in.

Drain Cleaners

More often than not, the drain cleaner you are using is more corrosive and harmful to your pipes than not. If you have a sink or bathtub that isn’t draining well, try snaking it first before you dump drain cleaner down there. Often, what is blocking your pipes is hair that cleaners won’t take care of very easily. If you do need to use a drain cleaner, invest in a non-corrosive one such as Bio-Clean (plumbers prefer this kind!)

Smoke Alarms

A quarter to about one third of smoke alarms don’t work because of missing or dead batteries. But what most homeowners don’t know is that having just one working smoke alarm can reduce the chances of you dying in a home fire by nearly 50 percent! If you can’t get to all of the smoke alarms regularly to check their batteries, focus on at least one for each floor. If you do have the time, be sure to regularly check your alarms and batteries (at least twice a year). Try working it into your cleaning routine, such as when you’re dusting.

Understand Insurance

Most homeowners are under the mistaken impression that their home is completely insured from catastrophe. This couldn’t be further from the truth. Most home insurance policies have stipulations and events that they do not cover. This includes things as major as housing floods and earthquakes. Additionally there is insurance for your appliances called home warranty insurance.

Ducts

According to some studies, the biggest problem with heating and cooling consumption comes from leaking ducts. You would be surprised to see that most of your energy consumption isn’t actually coming from you. Sometimes, not even heating technicians will check for leaks. If you check and feel like your energy consumption is still terribly high, invest in a good power quality meter. These devices can help gauge your family’s energy consumption and show you where you may need to cut back on energy use.

Colors

Choose colors for you house that will work now and later. Though this may seem trivial, it can save you money in the long run. If you enjoy painting your walls, pick something that can work well with different patterns and furniture. Generally, neutrals are best, such as grey or beiges. If you find in 10 years that you want a new red couch but your walls are blue or purple it may not work. Plus, if your walls are what you might call “boring” you can spice up your décor with stunning throw pillows, pottery, towels (in the bathroom and kitchen), and even beautiful rugs. By picking colors that can work always, you will find that you will save money from not having to repaint often and will also save you a headache from picking something that could work with already existing colors.

Your Breaker Panel

Most electrical panels already have labels or lists that indicate which breaker controls which circuit. However, these labels aren’t always completely reliable, especially in older homes with recent remodeling. In these situations, you might find that an outlet in one room is on a completely different circuit as all the other outlets in the same room but that one random outlet isn’t labeled on the circuit box. If you have an orphan outlet, or suspect you do, use a voltage detector to make sure the power is off before proceeding to do any electrical work.

Handy Work

If something can be fixed, you should fix it. Don’t think that some things should be ignored because they don’t seem important (just like those bad drains or smoke alarms). Other things you should fix when you can (or at least take care of) are black mold spots, any leaks, broken doorbells, sticking locks, torn screens, and so much more.

At the same time, if there is something that needs fixing especially big things like plumbing or heating issues, if you’ve done your research but still feel uneasy don’t shy away from hiring a professional. Oftentimes we think we can fix things that we really can’t and shouldn’t. Professionals are there for a reason.

73% of homeowners are paying too much for their home insurance! Let me tell you about three easy things you can do today to cut down your cost:

#1 – Give them more business and reap the rewards! – By combining your auto and home (or boat, motorcycle, RV, business, life, etc) policies with the same insurance company they will reward you with a multi-policy discount. If your insurance company doesn’t offer you this discount then chances are I can beat your current policies.

#2 – Cut the middleman out – Brokers make their money by charging a brokerage fee and they add that fee to your costs. By switching to a private insurance agent, you can cut out the brokerage fee and save yourself some additional money.

#3 – Discounts, Discounts, Discounts!!! – By installing a burglar fire alarm in your home you can save up to 20% off your policy. You can also get discounts for dead-bolt locks, indoor fire sprinklers, and even smoke detectors (which you should have anyways). If you currently aren’t offered these discounts, check with me to see what I can do for you.

This year California housing market conditions makes a strong and compelling case for homeownership. With prices still well below the historic highs of just a few years ago and attractive mortgage rates, qualified buyers have a unique opportunity to own their own home. As seen below, a rigorous analysis of renting versus buying hears this conclusion out. As shown in the following chart, the monthly housing costs (principle, interest, taxes, and insurance or PITI) associated with buying a median-priced home of $301,430 is $1,590 (Fourth Quarter 2010 median priced home in California). This assumes the buyer is making a 20 percent down-payment and financing with a 30-year fixed rate mortgage at 4.62 percent. In comparison, the median rent on a three-bedroom two-bath apartment with renter’s insurance in California is $1,810. That means buying a home would save the homeowner $220 per month when compared to renting and the homeowner would save over $2,600 a year. Reported by the National Association of Realtors

[email protected]

Direct: (949) 478-4466 | Fax: (310) 933-1619

DRE. Lic. # 01848917

Office: (877) 880-2929 x.4466 | Fax: (877) 881-2929 | www.crestico.com

1281 Westwood Blvd. Suite 102 Los Angeles, CA 90024

"To give real service you must add something which cannot be bought or measured with money, and that is sincerity and integrity."

The state of today's housing market leaves us all with something to be desired… but what we crave most is a GOOD DEAL. Whether you are a current homeowner, a former homeowner or a future homeowner; knowing what a short sale is and how you can make it work for you can help you save and make tons of money!

Now, if you're a homeowner facing foreclosure, this may be a great way for you to save yourself from the pain and drama of going through a foreclosure. If you're a buyer – you're in luck! Buying a short sale may save you tens of thousands of dollars on your dream home! If you're a current homeowner, not facing foreclosure, buying a short sale may just be that second home (and extra income) you can use to help you retire sooner!

To get started, you will need an agent. But not just ANY agent will do. You will need a specialist. Not just any agent can be a short sale specialist, although many will call themselves just that. You need an agent who is an EXPERT negotiator to deal with a short sale.

First, let's explain what exactly, this type of transaction is. Basically imagine a homeowner owes $500,000 on his home but can no longer make the payments and foreclosure is around the corner. You, as a buyer, can make an offer to the Lender that owns the bank for $400,000 and if you get approved, you've save the homeowner from foreclosure and pocketed a nice $100,000 savings! Extending yourself to distressed homeowners is a great way to be most successful at securing an approval. We have found that homeowners who are more than three payments behind on their mortgages are generally more amenable to such a transaction (and so are their lenders!).

Your agent will be KEY in getting an approval from the bank for you, which is why you must pick the right one! The agent handles negotiations with the bank and make sure that you are truly getting your money's worth.

For more information on how to find the best agent for you, click on the link below!

Remove shrubbery and trees that are too close to the home. Maintaining a 30 foot perimeter around the home free of large bushes and trees is recommended.

Remove shrubbery and trees that are too close to the home. Maintaining a 30 foot perimeter around the home free of large bushes and trees is recommended.