Buying your first home often comes with a wide range of emotions. You may understandably be excited about this prospect and eagerly looking forward to being a homeowner. However, you may also be feeling stressed out about finding a new home, paying for the home and the unknown aspects of the buying and mortgage application process. By learning more about the process, you can be better prepared for the experiences in store.

Location is Critical

Long before you begin looking for a dream home, you should decide on an ideal area of town or even a specific neighborhood that you want to focus your attention on. Everything from the crime rate and the quality of the schools to the cost of insurance, property appreciation rates and even your commute time will be impacted by the location you select. Ask your real estate agent to provide you with tax and crime data for neighborhoods you are interested in. In addition, the location of a specific home in a community is important. Visit the home at various times of the day to determine how noisy the neighbors are, how busy the street is and how many cars are parked on the street. You can also research the properties nearby to ensure that you will not have to deal with construction or other issues in the near future.

The Closing Costs Can Be Significant

You may have gone to great lengths to save up enough money for the down payment on a new home, but you may have underestimated the closing costs. In some cases, closing costs may be as high as two to three percent of the sales price of the home. With this in mind, take a closer look at your budget to ensure that you can fully afford to buy the home you want. You may consider asking your mortgage lender for a firm quote on closing costs as well.

There May Be Hidden Property Damage

It is easy to fall in love with a home that you tour, and you may be inclined to think that the home is in great shape because it looks fabulous. However, underneath a recently cleaned up, a well-manicured lawn and a fresh coat of paint, you may find serious and costly damage to the home. A property inspection is optional in many cases, and some home buyers may be inclined to save a few hundred dollars by avoiding this expense. However, a property inspection can provide you with detailed information about the true condition of the home. You may be able to negotiate with the seller to repair some of the damage before you finalize your purchase.

The Cost of Ownership Is Higher Than You Think

Many new home buyers fail to properly adjust their budget when preparing to move. Your new home purchase comes with added expenses related to home insurance, property maintenance and property taxes. It also may affect how much you pay for commuting, utilities and more. Even your personal auto insurance premium may change when you move because you may be changing zip codes. In addition, when you take on a significant debt, such as a home mortgage, you may be more inclined to need life insurance. There is additional cost for this. Carefully review all aspects of your budget to determine which items may change once you move. By doing so, you can minimize the financial stress you may feel after you move in.

While buying your new home can be a monumental event, many first time home buyers are unfortunately displeased with various aspects of the process. Proper preparation and planning can help you to reduce this possibility with your own home buying experience. You can easily explore these factors in greater detail as you embark on your home buying journey so that you are better prepared for the experience.

The fact that interest rates have dropped to near historic lows as the rents continue to sky rocket in most urban set ups, buying a home seems to tilt the balance to its favor. The reports by Trulia also suggest that for renting to become cheaper than buying, the 30-year fixed mortgage must hit at least 5% in Los Angeles and 5.1% in New York City. However, the mortgage rate has hit a low of 3.17%, making the projection unattainable, at least in the near future.

As much as the statistics favor home buying over renting, for many Americans, the financial tradeoff may not be easy. Numerous advantages come with home ownership, not to mention the tax deductibles on your mortgage interests. But if you don’t carefully analyze your financial situation and make informed choices, home ownership can turn into a financial nightmare.

The most critical component of your decision-making process should be your financial stability. You need to ask yourself key questions like: How stable is your job? How likely are can you get a pay raise or promotion over the coming years? Is your job likely to shift locations or cities? How stable is your marriage or relationship? Is there a possibility of splitting up or divorcing that may occasion untimely disposal of the home? And so on. If the answer to one or more of your questions indicates doubts on whether you will maintain the house within the next five years or more, then it would be pointless to commit yourself, regardless of the mathematics.

Change of Cities

If the nature of your job or appointment involves frequent relocation or change of cities, you may need to evaluate between buying and renting. Many home owners have suffered the cost of servicing mortgages for homes they do not live in. They even spend more resources in renting homes in their new location. Their efforts to sell may be thwarted when the timing coincides with the market lows when the mortgage interest rates rise, wiping out their equity and savings.

Financial Situation

Many Americans are living under strenuous financial situation and may not be in a position to save enough for the down payment. You need to analyze your individual financial status. The ultra-tight real estate markets like San Francisco even make it harder for aspiring home owners.

Home Insurance Costs

It is important to know that homeownership doesn’t stop with the acquisition of the mortgage. You’ll need money to settle your property taxes, and the mortgage company will require a proof of home insurance policy. When you rent a house, your landlord will cater for property insurance in addition to some utility bills like water, heating, or power. However, you may need to provide for your rental insurance, which is much more affordable. The policy still provides good benefits of homeowners’ insurance, except that it doesn’t cover the building structure.

Home Maintenance Costs

As a homeowner, you take responsibility for all your maintenance costs like fixing a leaking roof, the parading ants over your kitchen cabinets, broken toilet bowls, electrical breakdowns, and much more. And then there’s the dirty task of mowing your lawn, cleaning the compound, painting the walls, etc. When you decide to rent, most of these tasks will be done by the landlord or an appointed agent.

Bottom line

While it’s true that reduced rates are quite tempting to potential home buyers, you shouldn’t use the statistics to make costly purchases that could turn problematic. You can consider renting affordable housing alternatives like studio apartments as you put aside substantial savings for future investments. That way you’ll be able to make much larger down payment when the markets can’t offer better mortgage rates.

If you borrow less and give a huge down payment, the banks and the property sellers will prefer you over your competitors in a bidding situation. Additionally, your house will appreciate much faster in value as interest rates reduce, cutting down your financing costs.

Buying a home is a pretty big step in our lives. And knowing just what to do, how to do it, or everything that you need to do can get tricky and confusing. There a lot of people who will give you a lot of advice, but there are just a few that you should definitely pay attention to. We’ve rounded them up for you here to make that transfer from potential buyer to homeowner.

Homeowner’s Insurance

This is a big one. Homeowner’s insurance is one of the most important things that you can invest in for your new house. This insurance, like all insurance, is meant to keep you and your family and property safe from any potential damage or situations that occur.

Along with homeowner’s insurance, investing in a home warranty plan is also a very handy and important addition to your new space. A home warranty plan is a great way to keep your home systems, appliances, and so much more safe from the everyday wear and tear that comes from home life and from those “rainy days,” like a flooded basement, electrical fires, or just rambunctious guests or kids.

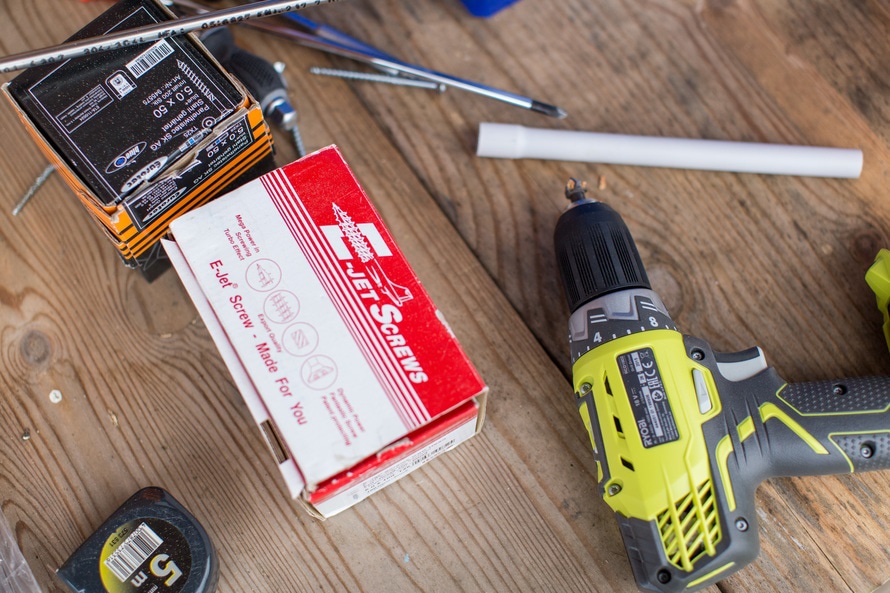

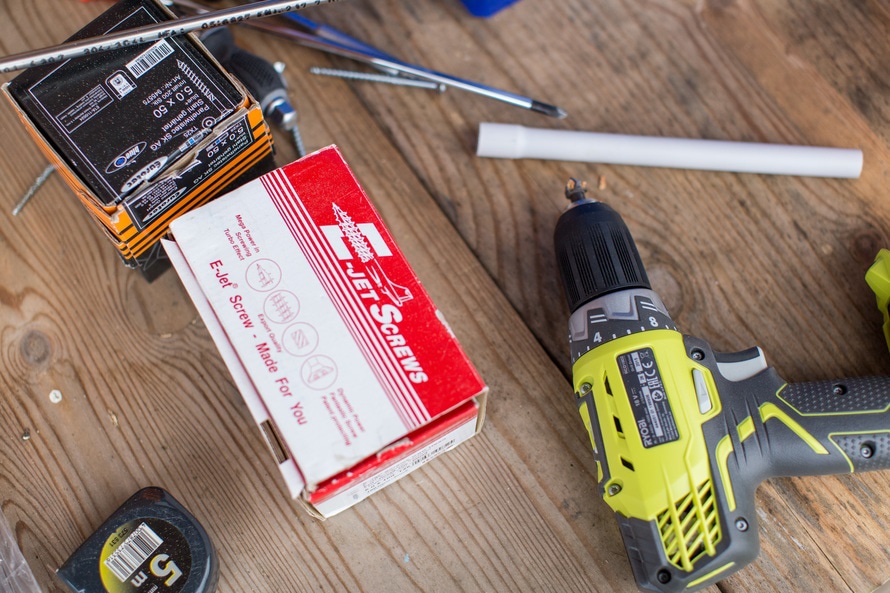

DIY Fixes

As a homeowner, unless you’re rolling in the dough, a great thing to do is learn how to do typical home maintenance and fixes yourself. Hiring a professional for every break, scrape, tear, leak, and more can really add up. Learning and teaching yourself how to do the basics can help you save so much in the long run. As a homeowner you need to become a bit of a “handyman.” You now own the space and don’t have a manager to rely on to take care of every clogged toilet or rouge ant parade in your home.

There are a lot of resources out there that can help you walk through how-to’s on fixing typical repairs around the house. You can check out DIY fixing websites or even Pinterest boards to help expand your new skill sets.

Home Maintenance

If you’re not buying a brand new home or building, there are a few things you should definitely do when you move into your new home.

Change the locks. Though the past homeowners may have given you all the keys they have, there might be a rogue cousin or neighbor who still has a set or two and you don’t want to run any risks. Install new deadbolts and even handle locks. You can do this for less than $10 per lock, or you can call a locksmith to have it down professionally. If you supply the new locks, the locksmith will generally only charge about $20 to $30 per lock for labor.

Check the insulation in the attic. If there isn’t enough, install more. This can actually be a money-saver tip too. There should be at least six inches of it everywhere. If it looks damaged, replace it too. A few other great things to do is to check for pipe leaks, replace air filters, clean out vents, air-seal the house, steam clean the carpets, spray for insects and pests, and check the breaker panel and outlets.

These are all great things to do before you move all of your furniture and personal belongings in. They are also things that might have gone unnoticed in an inspection. Once you do a good once-through of the house, start a brand new home maintenance checklist. You can find a template online. This will help you know when to change out smoke alarm batteries, air filters, and to service any home systems. Staying up-to-date on your home maintenance can help you to avoid any big repairs or disasters in the future.

Being Married to Your Mortgage

Too many homeowners think about their house as an investment instead of a cost-of-living. Your house is not an investment unless you can afford to give it up! This is not the case with most homeowners. Prior to getting a mortgage you should prepare to be spending a large sum of your monthly income, but not every penny. You want owning a home to be an experience that enhances your freedom, not restrict it. If you’re spending every earned penny on your mortgage then very little will be left over for desired non essentials that are still important. For instance, Weekend getaways, eating out with friends, Tour groups, and more. You should be able to have enough for a car or appliance break down (a rainy day fund) and then a little left over for the nice things in life.

Buying a home is not called the American dream for just any reason. It is a hard feat to accomplish and requires responsibility, hard work, and long term vision. It can also be scary for those buying their first home. There is a lot to know, and most have likely heard horror stories of friends homes that were hit by disasters, or who had issues dealing with insurance.

Fortunately home buying is not as scary as some people may think. There are plenty of professionals that you will work with along the way that will help make sure everything goes smoothly. Most people are surprised at the end of a first home purchase how simple the entire process was. There are costly mistakes that can be made, however, and should be avoided. Here are a few.

Choosing the wrong people

The people you work with while buying your first home are one of the most important decisions you can make. If you realtor is just in it for the money, they will push you to purchase a home as quickly as possible so that they can pocket the check and move on. Many realtors are trained to be this way. Conversely, if you can find a realtor that genuinely cares and has your best interest at heart, they will do digging, make sure there are no issues that could come up down the road with the home. These issues include things like improper paperwork with the city, hidden home damage, and overvalued home prices. A good realtor will do their homework and make sure your home is ready to live in safely for many years to come.

Budgeting

One of the biggest mistakes new homeowners make is understanding their budget. Most people that rent do not have to deal with repairs, maintenance, lawn work, taxes, insurance, or anything else relating to the home. As a new homeowner this is now completely your responsibility. If you are cutting your budget close while while buying the home you are likely forgetting the plethora of other expenses that may come up once the home is purchased. Make sure your income is enough to cover potential expenses and understand what those expenses could be. Additionally make sure that you have enough time to do things like yard work and maintenance, you will be surprised how much can be saved doing it yourself.

Research

Do the research! Find the perfect home. There is likely a home in your price range that you will love, but you need to spend the time to find it. Use resources like the Georgia MLS (or whichever state you live in) to find houses that may not be up yet on the web. Your realtor will have access to this.

DIY

Most first-time home buyers have zero clue how to fix anything in a home. Plumbing sounds gross, electricity sounds terrifying, and lawn maintenance sounds dull. Unless you are purchasing a brand new home however, you will likely run into some repairs and maintenance fairly soon. Your first reaction will be to call a handyman and let them deal with it.

This is probably the wrong first reaction. Most home repairs can be done with a YouTube video, a trip to home depot, and five minutes. You may be blown away by your ability to quickly understand how a toilet or sink work.

73% of homeowners are paying too much for their home insurance! Let me tell you about three easy things you can do today to cut down your cost:

#1 – Give them more business and reap the rewards! – By combining your auto and home (or boat, motorcycle, RV, business, life, etc) policies with the same insurance company they will reward you with a multi-policy discount. If your insurance company doesn’t offer you this discount then chances are I can beat your current policies.

#2 – Cut the middleman out – Brokers make their money by charging a brokerage fee and they add that fee to your costs. By switching to a private insurance agent, you can cut out the brokerage fee and save yourself some additional money.

#3 – Discounts, Discounts, Discounts!!! – By installing a burglar fire alarm in your home you can save up to 20% off your policy. You can also get discounts for dead-bolt locks, indoor fire sprinklers, and even smoke detectors (which you should have anyways). If you currently aren’t offered these discounts, check with me to see what I can do for you.